14 novembre 2023

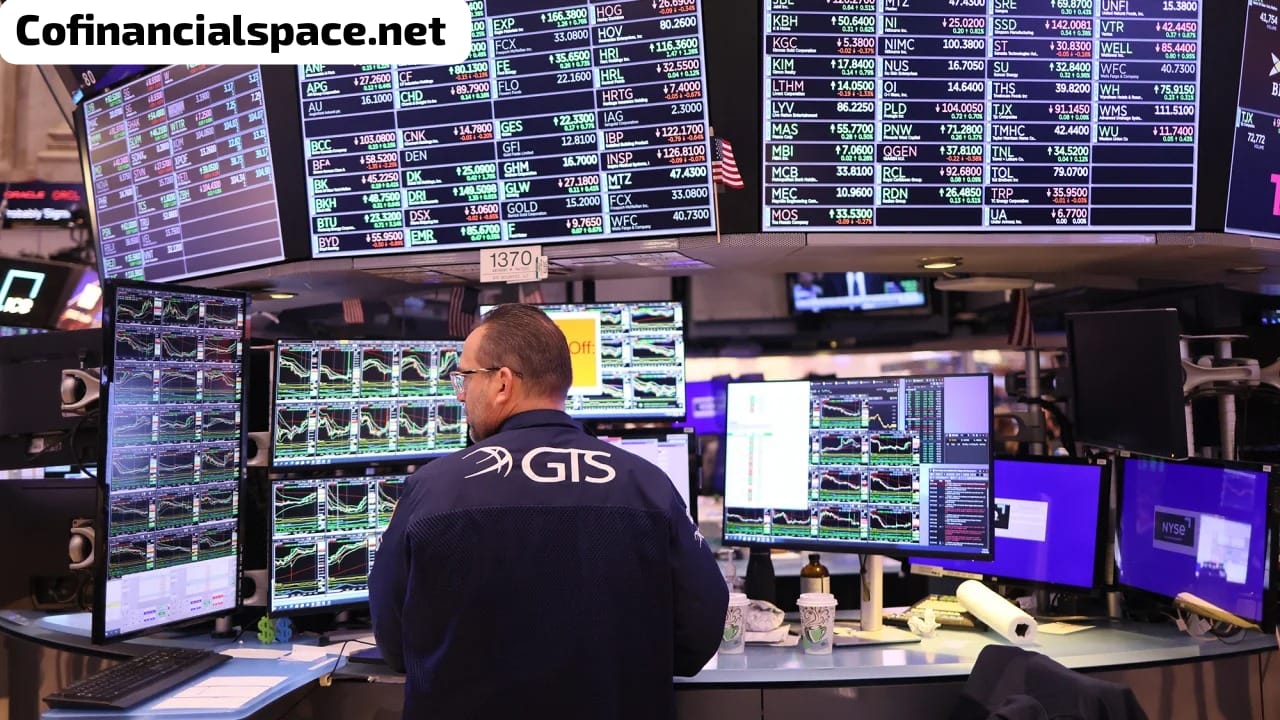

The financial landscape experienced a notable upswing on Tuesday, marked by a robust surge in stock values as Wall Street expressed optimism over the recent data depicting a significant decline in inflation during the month of October. The Dow Jones Industrial Average soared impressively, registering a remarkable gain of 518 points, equivalent to a 1.5% increase. Concurrently, the S&P 500 exhibited a commendable uptick of 2%, positioning itself for its most favorable day since January, while the Nasdaq Composite mirrored this positive trajectory with a substantial 2.3% rise, poised to achieve its best day since April.

This upward trajectory was in response to the release of the latest economic indicators, particularly the Consumer Price Index (CPI), which revealed a moderation in inflationary pressures. The CPI for the 12-month period concluding in October displayed a growth of 3.2%, a notable reduction from the 3.7% recorded in the preceding month, as reported by the Bureau of Labor Statistics. This outcome defied the expectations of economists, who had anticipated a marginal 0.1% monthly increase and a 3.3% annual rise, according to estimates from Refinitiv.

Furthermore, the Core CPI, which excludes the volatile food and energy categories, demonstrated a modest 0.2% month-over-month increase, resulting in an annual uptick of 4%. Notably, this represents the most modest annual increase since September 2021. In the wake of this data, Treasury yields experienced a decline, with the yield on the 10-year Treasury note settling at 4.46%.

Anticipation looms for additional economic indicators, as the October Producer Price Index, retail sales, and data on building permits and housing starts are scheduled for release later in the week. This follows the Federal Reserve's recent decision to maintain interest rates during its latest policy-setting meeting, a move that is widely expected to be reiterated in December, the final meeting of the year.

Commenting on the situation, Brad Conger, Deputy Chief Investment Officer at Hirtle Callaghan & Co., noted, "Today’s CPI validates that ‘wait-and-see’ approach. On the other hand, it will take a rather long series of this order of magnitude to give them confidence to ease policy." This perspective underscores the cautious stance adopted by the central bank in navigating the economic landscape.

The surge in stock values on Tuesday follows a more mixed performance on Monday, during which investors appeared to largely overlook Friday’s Moody’s Investors Service negative outlook for US credit. Notably, Home Depot shares experienced a notable uptick of 6.4% following the company's positive financial performance, surpassing Wall Street's revenue and earnings expectations. The company also reported strength in small improvement jobs, a pivotal aspect of its business.

In essence, the market's response to the inflation data and other economic indicators suggests a complex interplay of factors influencing investor sentiment, highlighting the delicate balance that financial markets navigate in interpreting and reacting to evolving economic conditions.