24 janvier 2024

Over the weekend, Bitcoin experienced a notable premium on Bitfinex in comparison to the global average price, suggesting that crypto whales may be engaging in bargain hunting amidst the ongoing decline in the value of the leading cryptocurrency. Crypto whales, characterized by their substantial token holdings, seem to be capitalizing on lower Bitcoin prices following the recent debut of U.S. spot ETFs.

Since the introduction of spot ETFs on January 11, Bitcoin has witnessed a nearly 19% drop, sliding to $39,770, according to CoinDesk data. This market movement has prompted crypto whales, particularly those on Bitfinex, one of the top 10 exchanges by trading volumes, to make strategic moves. Bitfinex whales are renowned for their influential impact on the market.

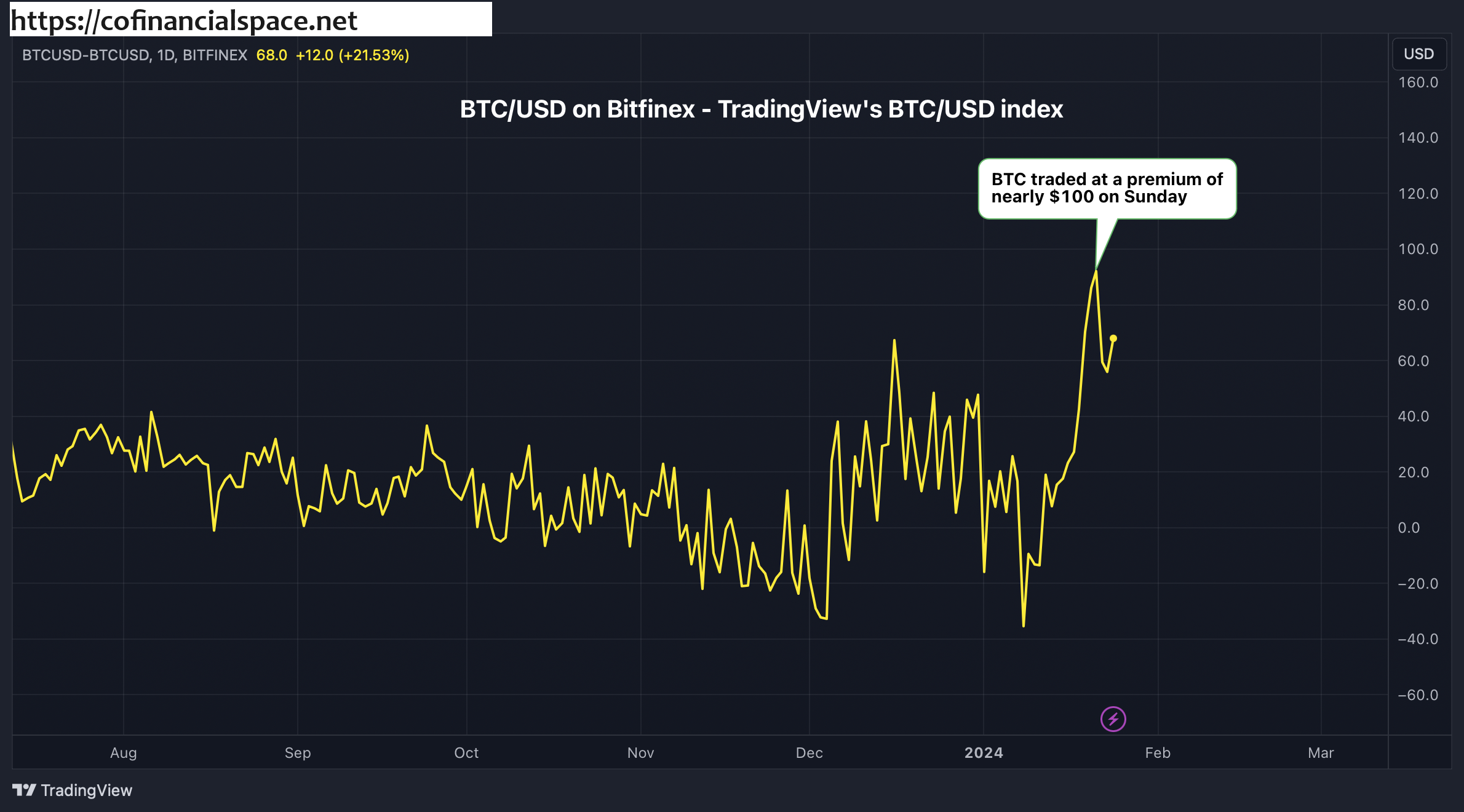

Data from TradingView reveals that over the weekend, Bitcoin was trading at a premium of $100 on Bitfinex compared to the global average price. As of the latest data, the premium remains around $70, notably higher than other major exchanges such as Coinbase and Binance.

A pseudonymous market analyst and trader known as Byzantine General noted, "Someone on Bitfinex has been nonstop TWAP buying $BTC for 3 days straight now, which is why Bitfinex has been trading at a fat premium. About $50m spot accumulated so far is my estimate." TWAP, or trade-weighted average price, is an algorithmic strategy used to execute large orders gradually, reducing slippage – the difference between the requested and executed prices.

This trend of TWAP buying persisted into Tuesday, fueled by sales from the FTX bankruptcy estate and outflows from the Grayscale Bitcoin Trust (GBTC), causing Bitcoin prices to dip below $39,000 for the first time since early December.

The demand during this dip is further evident through the renewed interest in bullish leveraged bets on Bitfinex. The market dynamics suggest that crypto whales are strategically taking advantage of the current market conditions to accumulate Bitcoin at discounted prices.