26 janvier 2024

BEIJING, Jan 26 (Reuters) - Several provinces in China, including the financial hub of Shanghai, have established conservative economic growth targets for 2024 after falling short of their previous goals. This signals that achieving a nationwide recovery to pre-pandemic levels might be challenging once again this year.

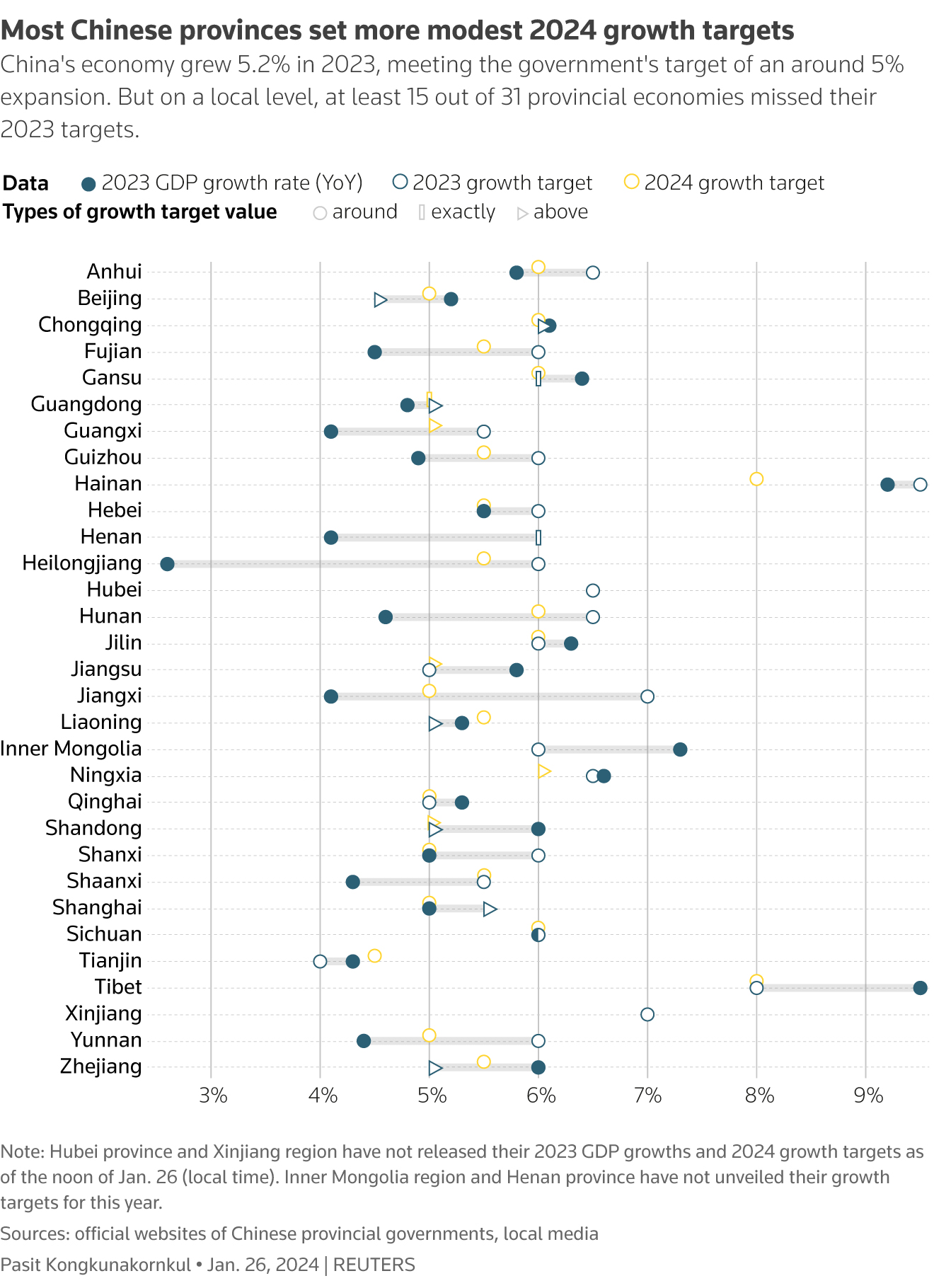

In the previous year, China's gross domestic product (GDP) expanded by 5.2%, meeting the government's target of approximately 5% growth. However, on a local level, at least 15 out of 31 provincial economies failed to reach their 2023 targets.

Heilongjiang in China's northeast, despite experiencing robust trade with Russia, reported only 2.6% growth, falling short of its goal of around 6%. Jiangxi posted 4.1% growth versus its target of around 7%, and Henan missed its target by 1.9 percentage points. Even Shanghai, recovering from 2022's stringent COVID lockdowns, once again failed to meet its growth target in 2023.

Insiders in policy circles anticipate that China will set a similar growth target of around 5% for 2024. A prolonged property slump, a weak private sector, and soft domestic consumption are expected to persist as challenges for the world's second-largest economy. China's GDP grew at least 6% annually in the decade before COVID-19.

Analysts, however, suggest that the economy may struggle to reach that target even with additional stimulus due to tepid demand and the ongoing property crisis. Some have proposed abandoning GDP goals to allow for more flexible policy-making.

As of Friday noon, among the 27 provinces, regions, and municipalities that have released their 2024 GDP targets, only five are aiming for higher growth compared to 2023, according to official statements and local media reports.

Given the "widespread" failure to meet targets, local governments' 2024 growth targets are deemed "more mild and realistic," according to Wang Jun, chief economist at Huatai Asset Management. Particularly, the 12 provincial economies with heavy debt burdens have mostly lowered their growth targets.

These 12 regions, identified as having a "high" risk of defaulting on debt obligations, include seven provinces such as Liaoning and Jilin on the border with North Korea, as well as Guizhou and Yunnan in the southwest, three autonomous regions, and the municipalities of Tianjin and Chongqing.

Amid rising external uncertainties and falling fiscal revenues due to the property downturn, local governments' ability to stimulate their economies has weakened, says Bruce Pang, chief economist at Jones Lang Lasalle.

At a key economic conference in December, top leaders urged major provincial economies to lead in driving growth and making greater contributions to the national economy. Since then, China's major economic powerhouse Guangdong has set a growth target of 5% this year, while Jiangsu aims for more than 5%. The Chinese capital Beijing and the wealthy province of Zhejiang are also targeting higher growth, with goals of around 5% and 5.5%, respectively.

To boost broader growth and support plummeting stock markets, China's central bank announced a deep cut to bank reserves on Wednesday, injecting about $140 billion of cash into the banking system.

The Economist Intelligence Unit expects China's leaders to set the annual growth target at about 5% again, stating, "Top leaders will probably consider a high growth target to be necessary to foster economic opportunities, restore public confidence, and quell sporadic social discontent."

Reporting by Ellen Zhang and Ryan Woo; Additional reporting by Beijing newsroom and Kevin Yao; Graphic by Pasit Kongkunakornkul; Editing by Shri Navaratnam